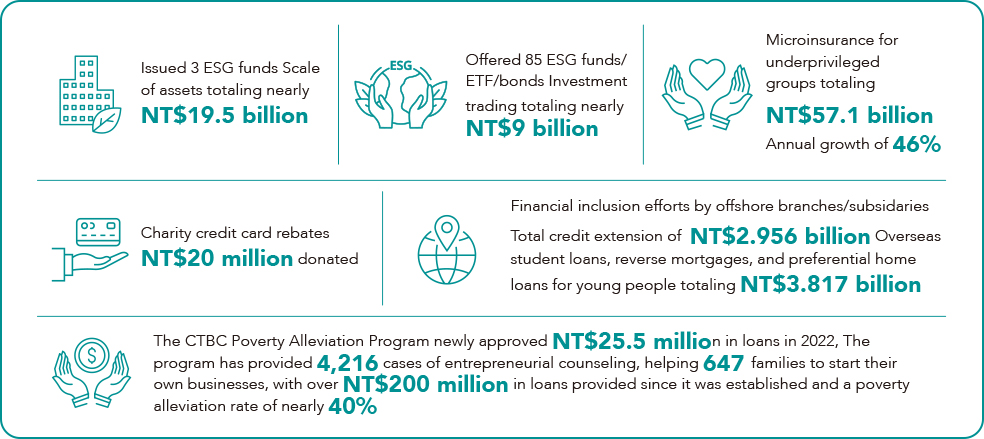

To protect the rights of our shareholders while creating a positive impact on society and the environment, CTBC Holding, together with our subsidiaries, implement impact financing by adhering to international sustainable finance initiatives and by developing sustainable investments and financing as well as sustainable products and services. After the launch of 2021 Impact Valuation Pilot Study Report in 2022, CTBC Holding has continued to enhance the group's impact investment policy since, and publishes this―Taiwan's first Impact Investment Report―in 2023 to disclose the Company's definitions and vision for impact investment for the first time, as well as to take an inventory of subsidiaries' private equity and sustainable bond targets by using international

frameworks and standards including the SDGs, the five dimensions of the Impact Management Project (IMP), and the IRIS+ Impact Themes and categories. The impact investments covered in this Report are correlated with six major IRIS+ Impact Themes: Clean Energy, Energy Efficiency, Pollution Prevention, Access to Quality Health Care, Smallholder Agriculture, and Waste Management. In the second half of this Report, we share a representative case of each Impact Theme and describe the impact results of the six investment targets through the IMP methodology. We intended to use the report to further to exert CTBC Holding's sustainable financial impact.

Impact finance

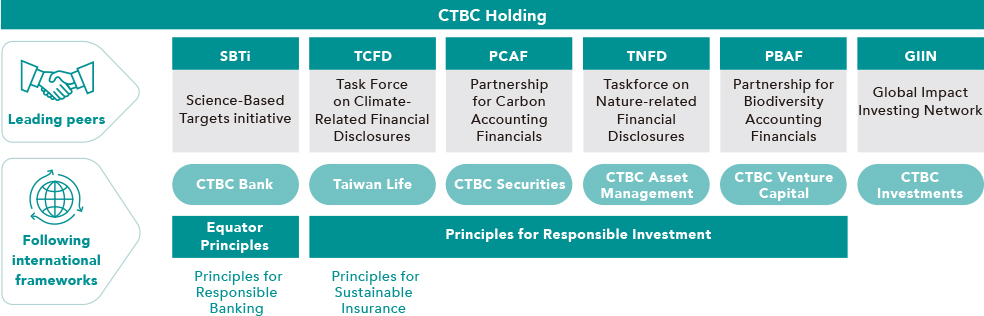

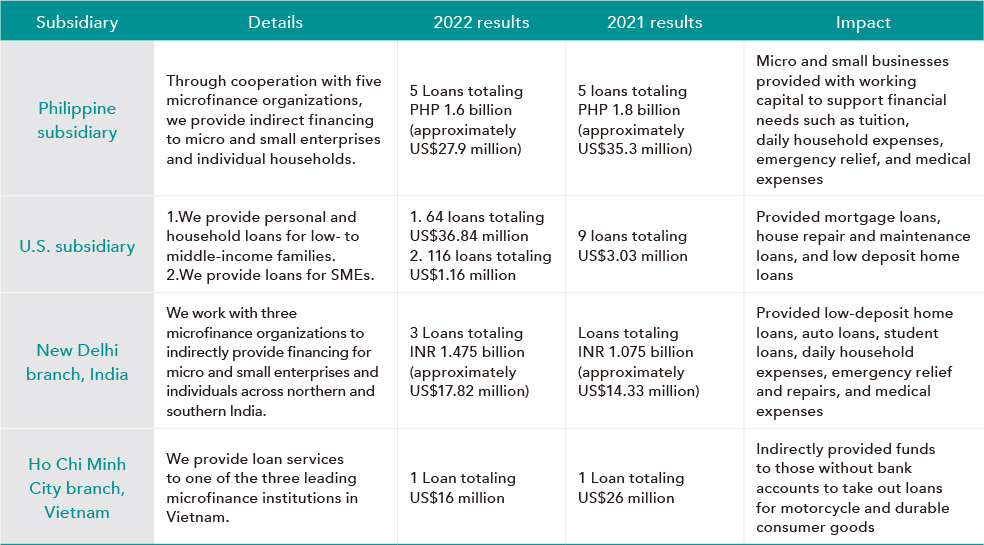

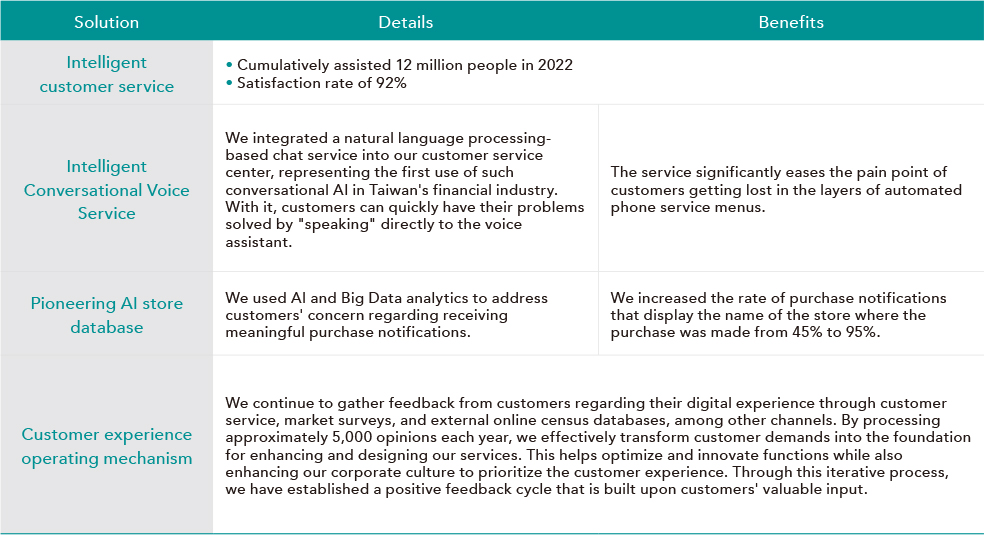

As Taiwan's leading international financial institution, CTBC Holding actively engages in international sustainable financing initiatives to ensure interests of shareholders as well as to create positive impacts for society and the environment. By aligning our efforts with global sustainability best practices, we continue to innovate financial products and services and to assist customers in their sustainable transformations. In addition, we also provide diverse inclusive financing products and services in Taiwan and abroad to support financial inclusiveness.

Our ultimate aim is to use financing in order to promote low-carbon transitions and help underprivileged groups. As well as reducing negative environmental and social impacts, we also aim to further create positive impacts and to build a better, more sustainable society through impact finance.

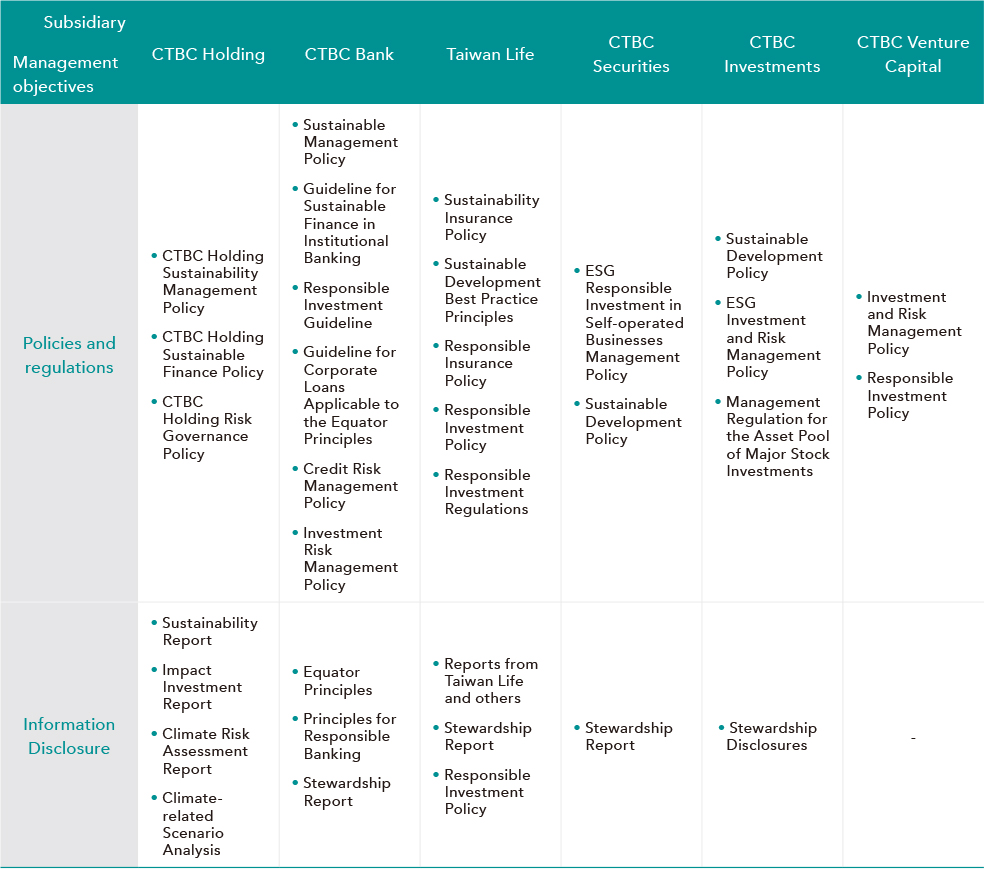

Sustainable finance management objectives

CTBC Holding's Sustainable Finance Policy stipulates the four implementation principles of "Actively support and advocate for sustainable finance," "Focus on creating positive impacts related to the SDGs and the climate," "Drive the low-carbon economy and work toward net-zero emissions by 2050," and "Integrating enterprise resources to expand business synergies" as the guiding principles for the Company and its subsidiaries in promoting sustainable development and finance related-business. All subsidiaries have since dictated in relevant risk, investment, and financing-related policies and regulations that their financing business shall fulfill ESG management obligations and continue to be optimized in the future. Sustainable finance management objectives from CTBC Holding and major subsidiaries:

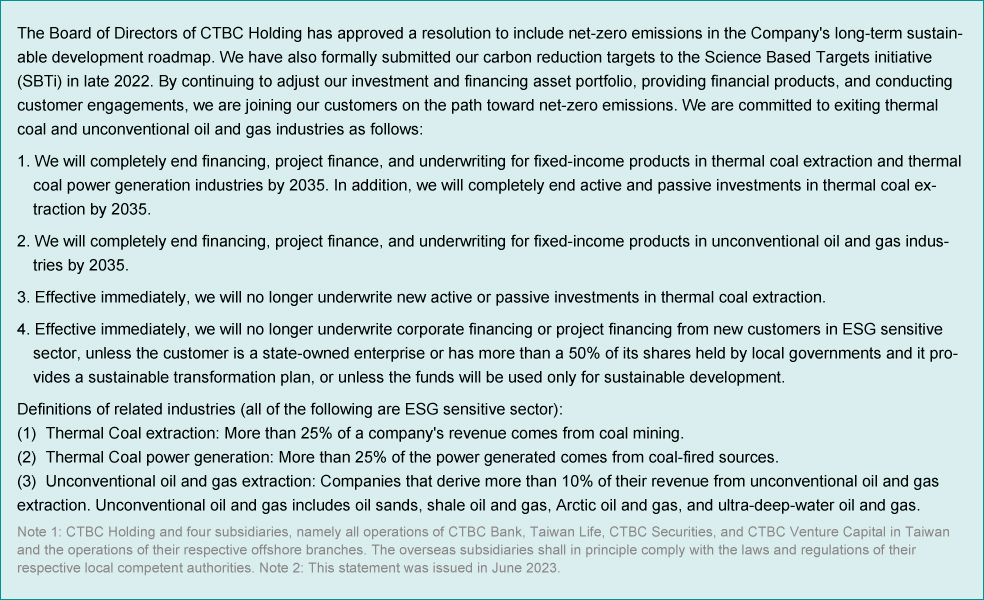

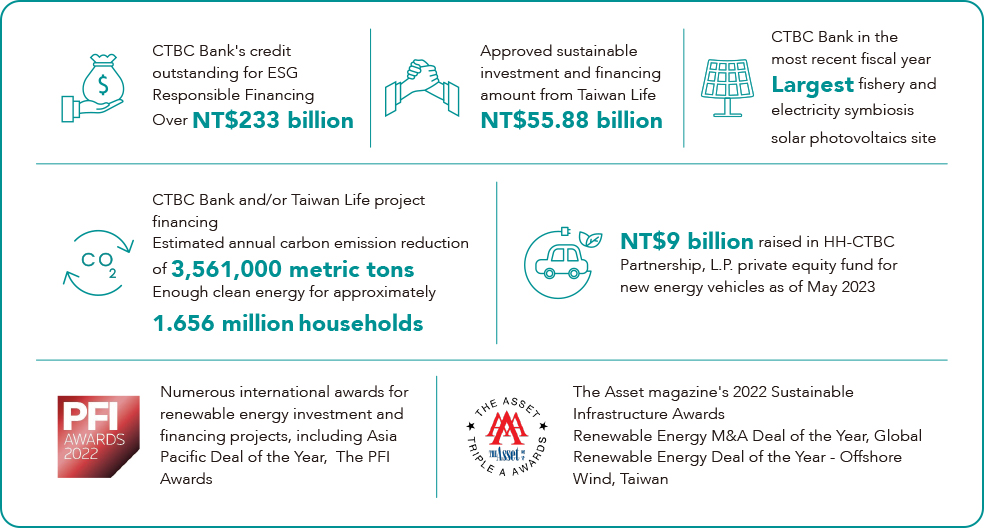

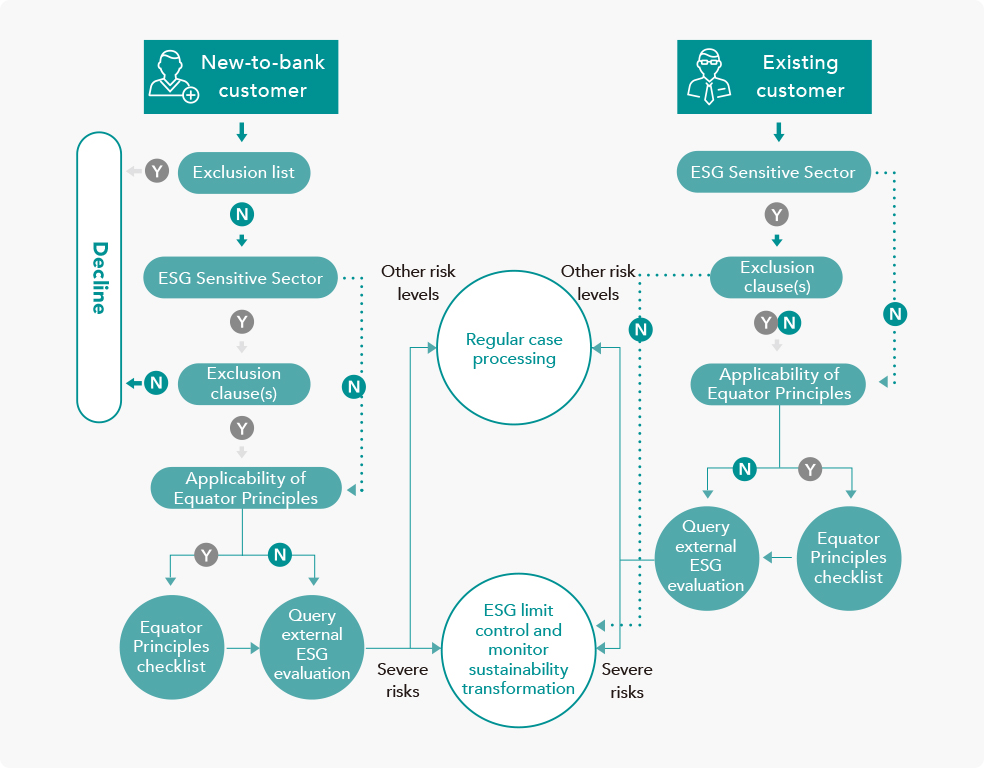

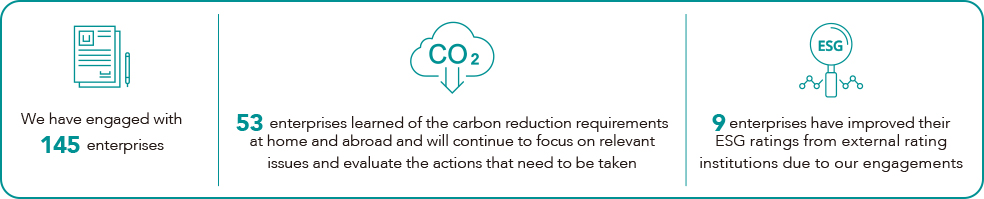

Sustainable financing

In 2021, CTBC Bank established the Guideline for Sustainable Finance in Institutional Banking. The guideline prohibits the Bank from granting credit to companies in industries that adversely impact social or public safety, including through crime, terrorism, arms, and pornography. Regarding ESG Sensitive Sector involving material environmental and social issues (i.e., thermal coal extraction, thermal coal power generation, tobacco production, and oil sands), we have pledged not to grant credit to new companies belonging to such industries unless (1) the funding purposes of the facilities are used for sustainable development or (2) the company is either a state-owned enterprise or has more than a 50% of its shares held by local governments, and on the condition that the company can provide evidence of sustainable transitions; this ensures that we can encourage customers to undertake sustainable transition. Companies classified as ESG high-risk companies or categorized into ESG Sensitive Sector are subject to regular monitoring and controlling. Moreover, in order to promote the development of a low-carbon economy, the Bank has inventoried the status of clients in carbon-intensive industries. For borrowers belong to ESG high-risk, ESG sensitive sector and carbon-intensive industries, the Bank conducts proactive engagement and provides ESG related products and services to encourage these companies to invest in sustainable transition.

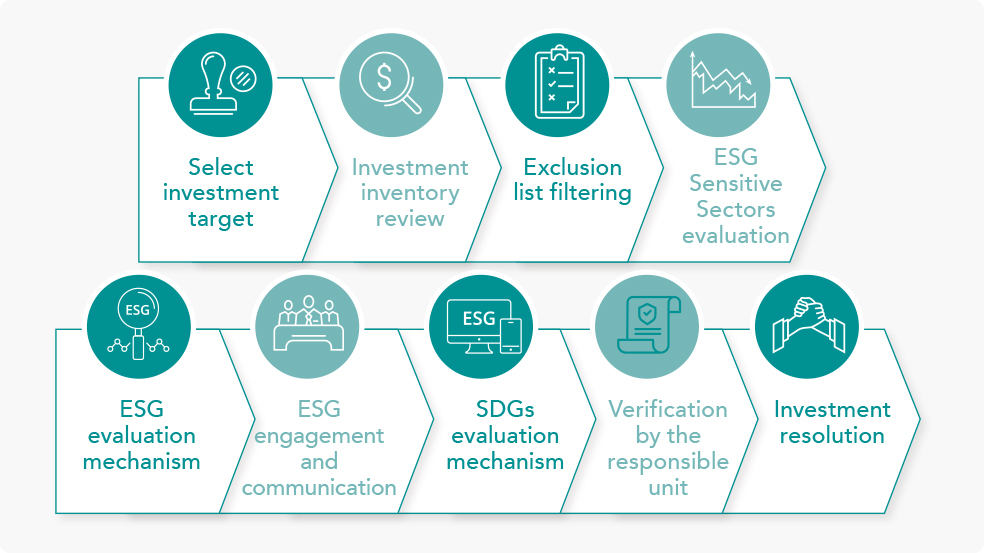

Responsible investment

CTBC Holding's subsidiaries are prohibited from engaging in investment activities involving criminal or terrorist activity, arms, or pornography; our definition of ESG Sensitive Sector is consistent with sustainable financing norms. Furthermore, at Taiwan Life, the ESG performance of an investment subject is evaluated using an external ESG rating system, and the investment subject is reviewed using an ESG risk assessment form. For enterprises that have failed to meet the standards, further engagement and communications are deemed necessary in order to reduce the possibility of investing in high-ESG risk enterprises. Investment amounts or the number of collaboration opportunities may be increased if improvements are observed after the engagement. Regular post-investment management is conducted to ensure that investment subjects regularly monitor their respective levels of involvement and ESG risk-related matters.